I. Introduction A. Overview of the Policy Reversal In early April 2025, President Donald Trump’s administration announced a significant U-turn in its tariff policy—a decision that reversed many of the tariffs initially imposed last week on nearly every country. Prior to the reversal, the tariffs had created widespread disruptions in global markets and triggered substantial stock market volatility. However, in a dramatic shift on April 9, the White House unveiled that the reciprocal higher tariffs imposed on most countries would be placed on hold for 90 days, with the exception of a more stringent tariff framework reserved exclusively for China. B. The Role of Social Media in Policy Signaling In a controversial twist, just hours before the official announcement of this policy reversal, President Trump posted on his social media accounts a message that read, “THIS IS A GREAT TIME TO BUY!!!” The timing of this tweet—four hours prior to the White House’s statement—prompted immediate speculation that Trump’s outburst might have been designed to send a deliberate market signal to his followers. This report examines the possibility that his tweet served as a “get-rich warning” or even as an inadvertent nudge for investors in the context of a market recovery that soon followed.C. Rationale for an In-Depth Analysis Given the considerable financial implications of the tariff reversal—which helped to restore trillions of dollars of market value that had been wiped out in a matter of days—this article provides an in-depth exploration of several key dimensions: The economic rationale and international trade context behind the initial tariffs and their subsequent rollback.The use of social media by a sitting president to communicate policy signals that might affect domestic financial markets. The broader political, regulatory, and ethical issues raised by such communications, including potential investigations for insider trading and market manipulation. The reaction of investors, policy makers, and the public to this unprecedented mix of trade policy and social media strategy.By carefully dissecting these aspects, the analysis aims to offer a balanced perspective on whether this incident represents a calculated strategy to manage market volatility or an irresponsible example of presidential communication interfering with economic stability.

Related Posts

30 Secrets People Found On Their Partner’s Phone That They Wished They Never Did

Most of us have a deep connection to our phones. Whether we use it to doomscroll, search for the best burger in town, or navigate to a…

30 Secrets People Found On Their Partner’s Phone That They Wished They Never Did

Most of us have a deep connection to our phones. Whether we use it to doomscroll, search for the best burger in town, or navigate to a…

A7-year-old boy – Patrice Purple

Investigators believe the children’s injuries were caused by a household appliance activated while they were unattended. Authorities suspect the 7-year-old turned it on without realizing the danger….

A7-year-old boy – Patrice Purple

Investigators believe the children’s injuries were caused by a household appliance activated while they were unattended. Authorities suspect the 7-year-old turned it on without realizing the danger….

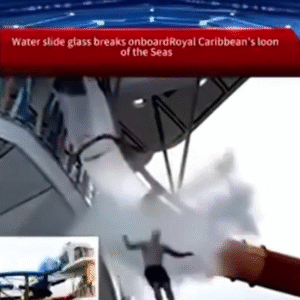

A shocking accident on the world’s biggest cruise ship — Royal Caribbean’s Icon of the Seas. One of its famous water slides malfunctioned after an … See more👇

Royal Caribbean’s Icon of the Seas, the world’s largest cruise ship and a marvel of modern engineering, faced an unexpected incident this week when one of its highly…

A shocking accident on the world’s biggest cruise ship — Royal Caribbean’s Icon of the Seas. One of its famous water slides malfunctioned after an … See more👇

Royal Caribbean’s Icon of the Seas, the world’s largest cruise ship and a marvel of modern engineering, faced an unexpected incident this week when one of its highly…